How To Calculate Common Stock

This video explains what common stock is in the context of financial accounting. An example is provided to illustrate the journal entry required to record the issuance of common stock. Book value per common share (or, simply book value per share - BVPS) is a method to calculate the per-share value of a company based on common shareholders' equity in the company.

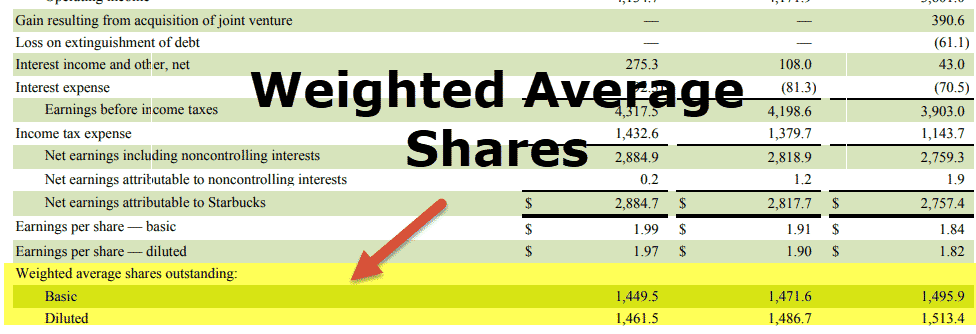

When you buy stock in a company, you are buying a percentage ownership in that business. How much of the business your one share buys depends on the total common stock outstanding, a figure you can easily determine using the company's balance sheet.What common stock outstanding means, and why you should care The common stock outstanding of a company is simply all of the shares that investors and company insiders own. This figure is important because it's used to translate a company's overall performance into per-share metrics, which can make an analysis much easier to do in terms of a stock's market price at a given time. If there are 100 shares outstanding and you buy one, you own 1% of the company's equity.The life of common stock goes through a few phases, and understanding each step is important for putting the common-stock-outstanding number into proper perspective.First, the board of directors authorizes the company to issue a certain number of shares. That initial figure is appropriately called 'authorized' stock. The company hasn't taken action yet; it's just gotten approval to take action and sell some shares if it chooses too. As an example, let's say that a fictional business, the Helpful Fool Company, has authorized 5,000 shares.Next, the company issues shares.

This 'issued' stock can be less than the total authorized, but it can never be more. The board, after all, only greenlighted the authorized amount. At this point, the 'issued' and 'outstanding' stock are equal.

Company management or investors own all of the issued stock. Helpful Fool Company's board has elected to issue just 2,000 shares at this time. Therefore, the company currently has authorized 5,000 shares and has 2,000 shares issued and outstanding.Many companies elect to buy back shares as part of their capital-allocation strategy. When a company buys back its own shares, that stock is accounted for as 'treasury stock' on the company's balance sheet. Treasury stock is no longer outstanding - the company itself now owns it, not an investor or employee - but that stock has still been issued.Let's say that Helpful Fool Company has bought back 500 shares in this year's buyback program. The company now has 5,000 authorized shares, 2,000 issued, 500 in treasury stock, and 1,500 outstanding.

The outstanding stock is equal to the issued stock minus the treasury stock.Thanks to the SEC, common stock outstanding is very easy to calculate All companies are required to report their common stock outstanding on their balance sheet. The easiest way to calculate the number is to simply look it up. Do that by navigating to the company's investor-relations webpage, find its financial reporting, and opening up its most recent 10-Q or 10-K filing. The same can be done on the SEC's website as well. From there, simply scroll down until you find the section in the 10-Q or 10-K called 'Capital Stock.' All the details you need will be there, plain to see.

You'll see the various other stock categories I've discussed, so don't let that confuse you. One possible point of confusion we haven't yet mentioned is stock given to employees as compensation, typically in some combination of restricted stock, options, or equity grants. That stock should be included in the common-stock-outstanding figure.The calculation for common stock outstanding can seem a little daunting at first simply because there's so much accounting jargon used to define and calculate it. Don't worry - the concept is really pretty simple.

How To Calculate Common Stock Formula

And now that you're equipped with this foundation of knowledge, all you need to do to figure it out is to go look it up on any company's balance sheet in their 10-Q or 10-K filing.If you're interested in learning about common stock, you may also in learning about the best broker available for your needs, so visit our to discover the possibilities. Sinead harnett chapter one zip download.